The Emergence of White Label Mobile Banking Solutions in Europe and UK

Our mobile banking solutions in the UK prioritize security and data protection, employing robust encryption protocols, biometric authentication, and multi-factor authentication methods to safeguard sensitive information and mitigate the risks of fraud and cyberattacks. Regulatory bodies such as the Financial Conduct Authority (FCA) closely oversee mobile banking operations, ensuring compliance with industry standards and consumer protection regulations.

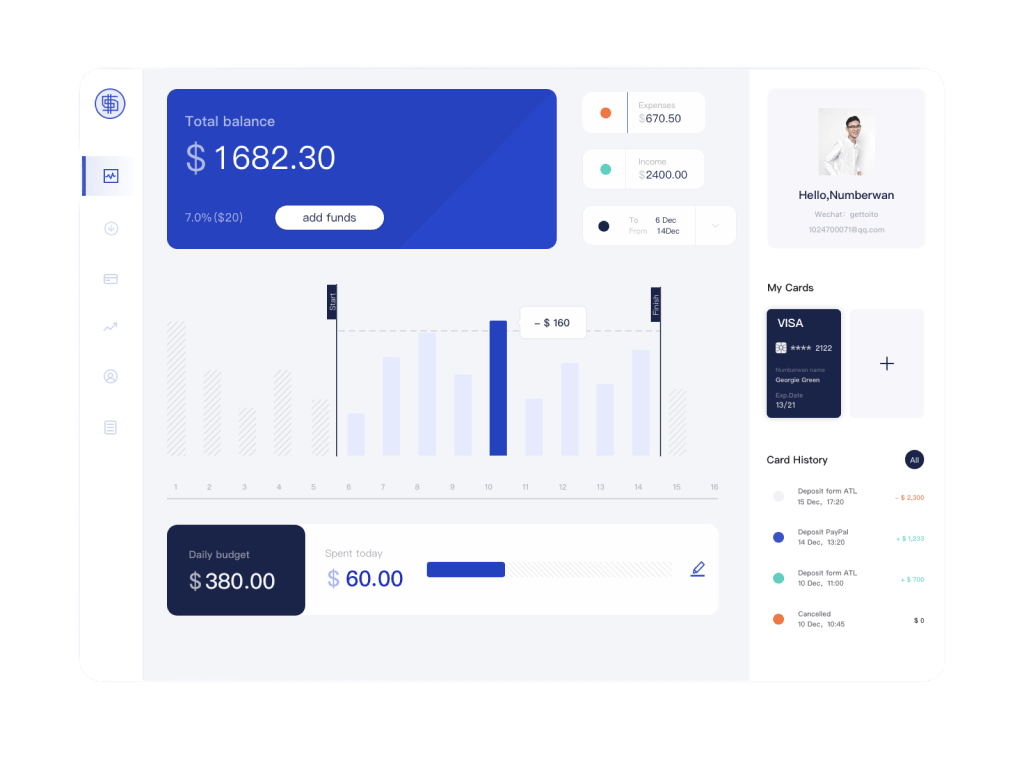

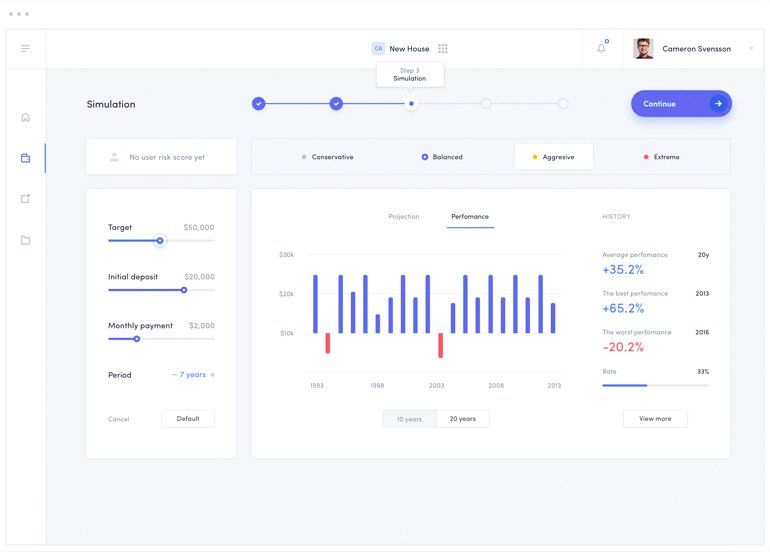

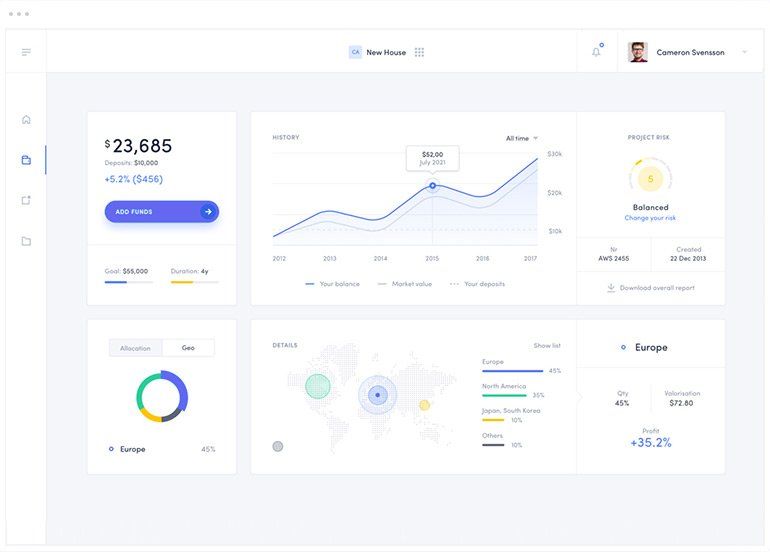

In parallel, the emergence of white label mobile banking solutions in Europe has democratized access to banking services, enabling non-bank entities, fintech startups, and established institutions to leverage pre-built mobile banking infrastructure and regulatory licenses to offer branded banking experiences to their customers. White label mobile banking solutions empower partners to customize their mobile banking platforms, integrate value-added services, and extend their reach to new customer segments without the need for significant upfront investment in technology or regulatory compliance.

Benefits Of Using White Label Mobile Banking

White Label Banking App Development Process

To ensure that we can meet the needs of each client, we have carefully curated an agile white label banking app development.

-

Requirement

Our team communicates with the client to comprehend the requirements of the project.

-

Analysis

We conduct a thorough project analysis and evaluate the project’s requirements and viability.

-

Planning

We inform the client of the white label project’s budget, schedule, and other requirements.

-

Development

We develop a digital app that satisfies the client’s requirements.

-

Testing

Our white label mobile banking app undergoes various testing phases before delivery to the client

-

Maintenance

We offer post-maintenance services so that the website operates with maximum performance avoiding glitches.