Cobranding Prepaid Card Issuer and Provider in UK

Prepaid cards, characterized by their flexibility, convenience, and accessibility, have gained popularity among individuals seeking alternative payment methods and financial management tools. In the UK, prepaid cards serve as viable options for unbanked or underbanked individuals, travelers, students, and individuals seeking budgeting solutions.

Cobranding between prepaid card issuers and providers in the UK represents a strategic alliance aimed at enhancing financial accessibility, convenience, and inclusivity for consumers. We explore the dynamics and benefits of cobranding partnerships in the UK prepaid card market, highlighting the symbiotic relationship between issuers and providers in delivering innovative financial solutions to diverse consumer segments.

Brand Mastercard issuance for Fintech, Marketplace and other businesses.

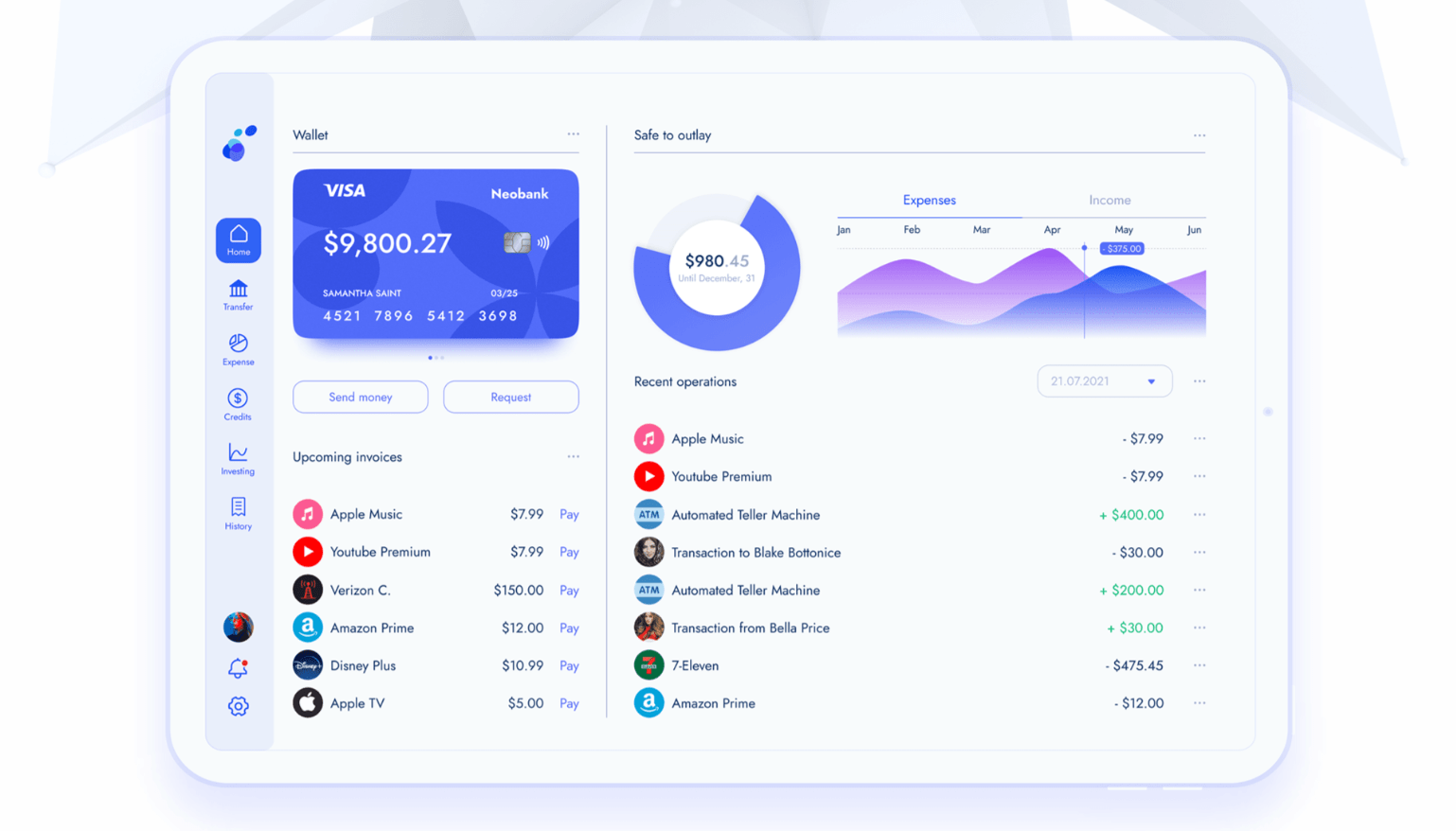

Personal Spending Cards

Keep your card for personal spending, shopping or to pay regular bills. Track your card spending.

Employee Expenses Cards

You can enabled card limits and manage expense for employees to make payment on daily basis.

Suppliers/ B2B Payment Cards

Get your business card to pay regular suppliers bills. Even set up automatic payments and subscriptions

International Spending Cards

Get our multicurrency card for international spending to buy international ticket or shop locally.

Social Entertainment Cards

Better control of your expenses for recurring on Facebook or any social sites including dating sites or buying online games.

Online Shopping Cards

Our card design for Ecommerce card. Convenience Lower Costs. You can always set minimum or maximum limits or even freeze the card.