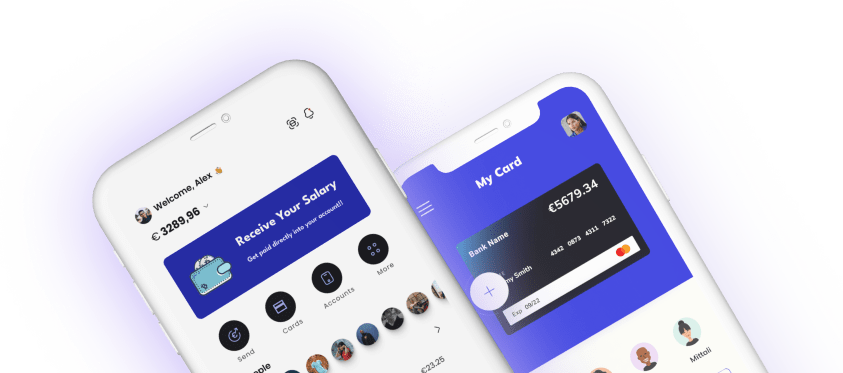

White Label Banking Platform as a Service

Quickly and easily go to market White Label Banking Platform with Open Banking payments, business accounts, cards, digital wallets or any of our payment products. Working together with us, you have access to all the technology, licenses and expertise needed to roll out innovative digital payments services under your own brand. You will get your ready to use White Label Solution in few weeks.

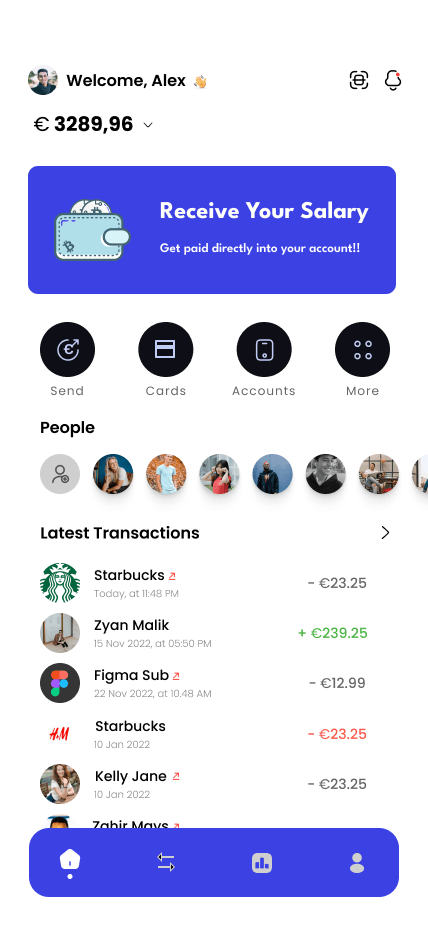

Get ahead of the competition on Open Banking and offer brand new account-based payments that can be requested and received online, on mobile or by QR code. We also have the know-how to help you quickly offer high volumes of multiple-currency digital accounts and virtual cards with all the features of a premium business bank account – and much more.

White Label Banking Platform as a Service

Whatever payment service you need, our powerful API ensures deep integration with your own systems. We will work with you to optimize your new payment products by developing customized APIs existing digital channels.

From the technology development to licensing and regulations, bringing new financial products to market is a costly and complex process. With decades of experience in financial services, we can work with you to understand your business opportunities and provide direction on the best solution for you. Independently owned, we are dual-licensed in the EU and UK, and regulated to provide payment services for over a decade, so you can trust us to bring your product to life.

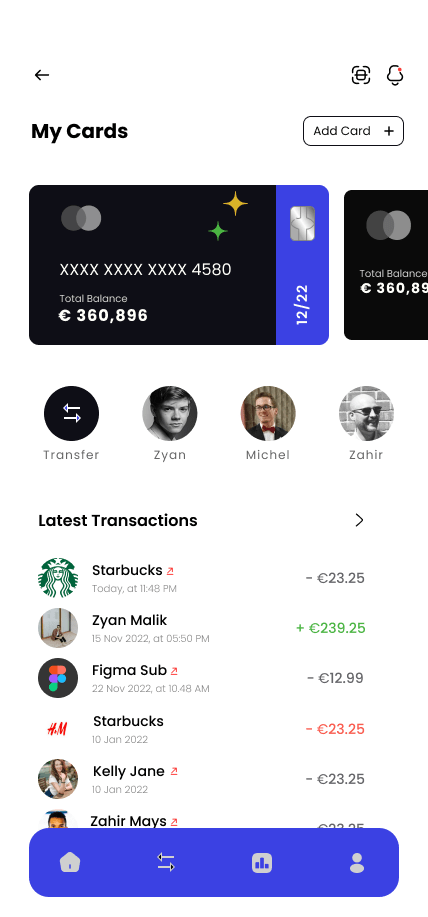

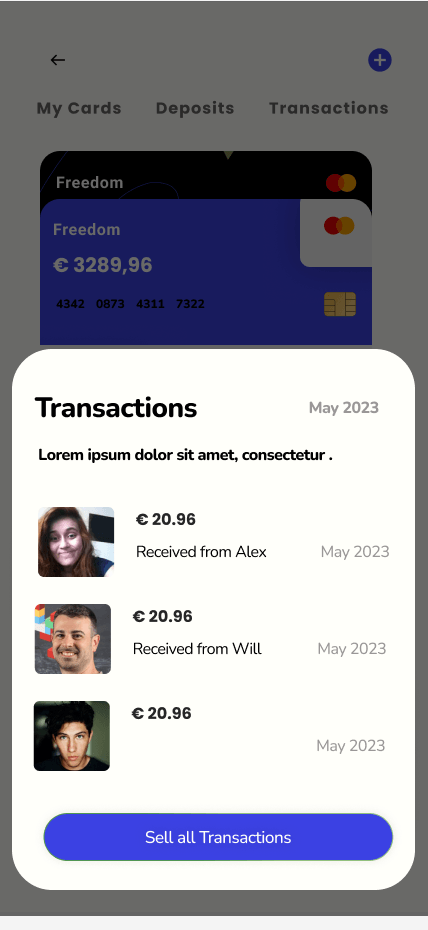

Virtual e-Banking Enabled for

Freelancer and All Type of Businesses

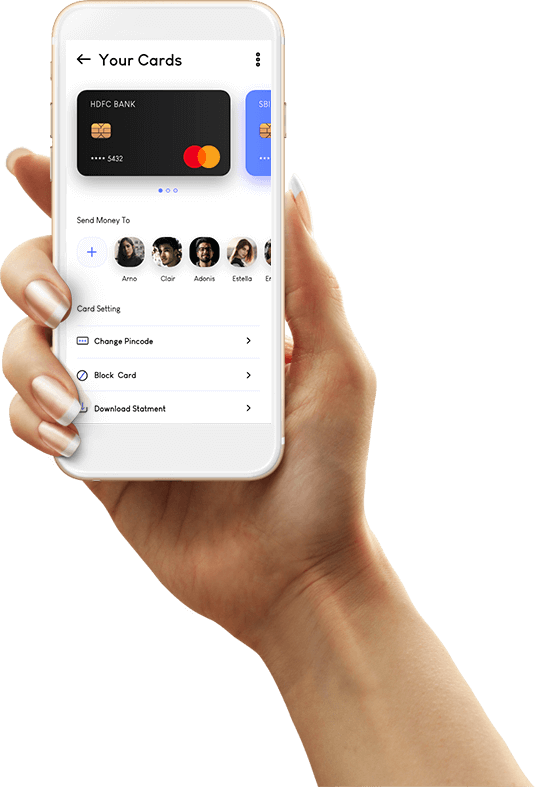

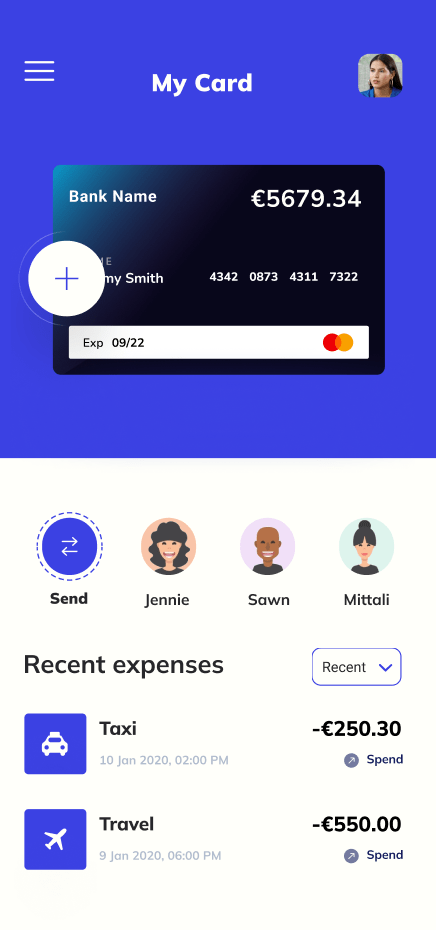

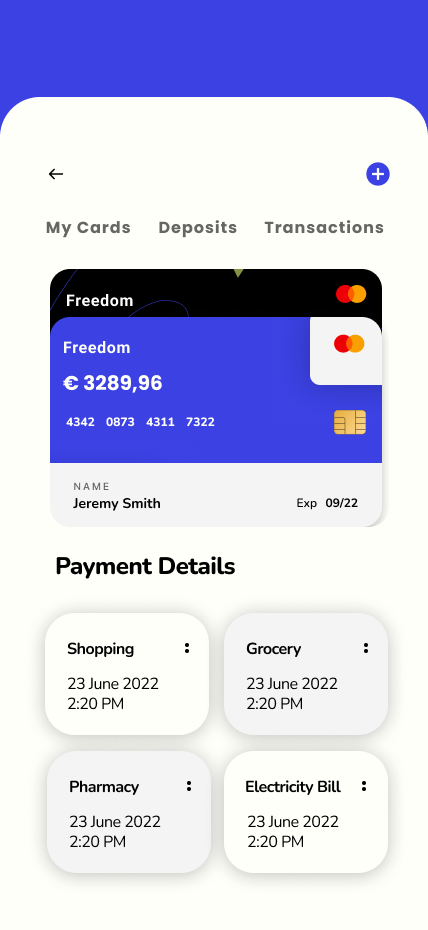

Spend funds. Get Branded Prepaid Card

Virtual cards for your everyday needs, spending control in your hands. Spend anytime, anywhere . Get free multiple cards

How White Label Banking Works

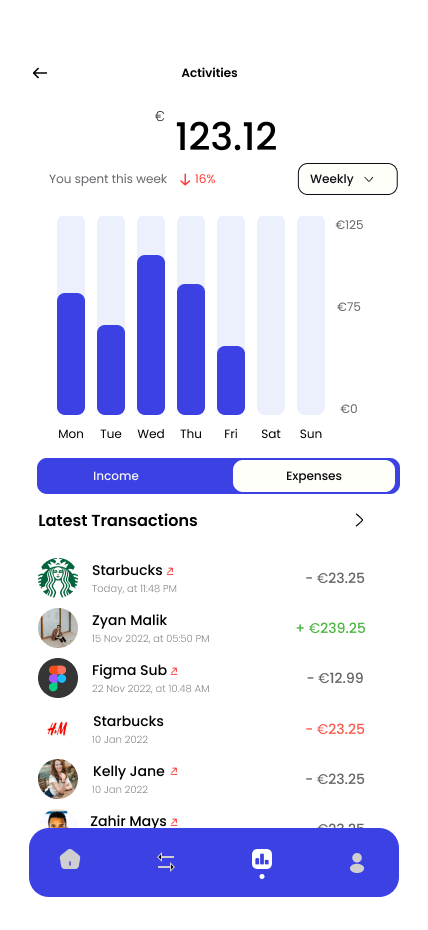

We offer European White Label eBanking to Fintech and Finance companies

Basic Banking

Get answers to common questions about White Label Banking

How do I get my accounts verified successfully?

Some tips to get your account verified

- Take a clear photo/scan legal document where all the details are readable, not blurred. Eg. Driving License or Passport or National IDs

- Take a photos in an illuminated area with no shadows.

- Turn off your camera flash to prevent your documents from reflecting.

- Make sure that your Fibanq account name matches your legal document name.

- Your legal document is over 3 months away from expiry.

- An image of photo or photocopy will not work.

How to deposit fund into my account?

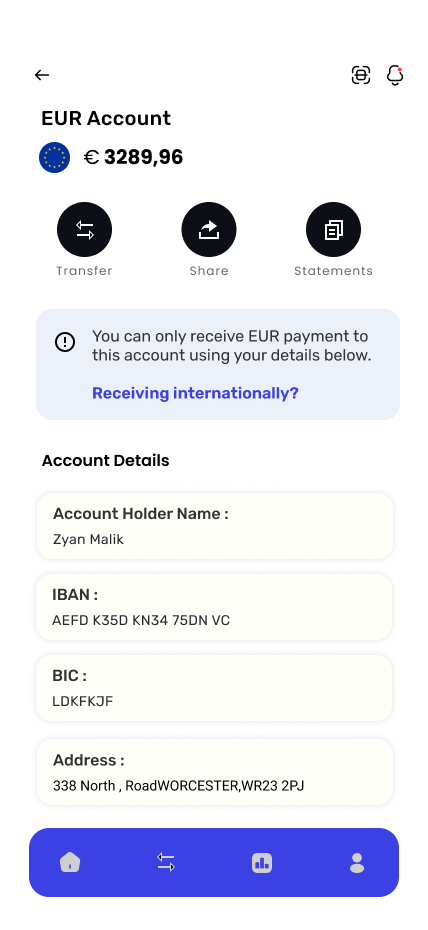

You can perform fund deposit in your desired Bank account

- Easily navigate your multiple accounts in GBP /EUR currencies, select to see IBAN/ACCOUNTS with Sort Code

- You can deposit fund from your own another bank accounts

How my accounts are secured?

Each account is secured by 2FA verification and biometrics information to secure your transactions and accounts. Accounts activities are always being monitored by due-diligence experts.

Countries or regions where I can transfer fund

We support Fast Transfer in the United Kingdom and SEPA = Single Euro Payment Area.

A credit transfer is an electronic payment from one bank account to another within the European area and in the currency EUR alone. The SEPA Credit Transfer (SCT) scheme makes the transfer of money in Europe easy, convenient and fast.

What countries make up the 33 Country SEPA Zone?

The 27 EU member states are: Austria, Belgium, Britain, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovenia, Slovakia, Spain and Sweden. The additional participant EEA countries are: Andorra, Norway, Liechtenstein, Iceland, Switzerland, and Monaco.

My account verification is rejected, what should I do?

On Dashboard you will be able to see your account status- If an account is rejected due to missing of any document or due to wrong submission. You can Verify it again by submitting the correct documents.

Is there any transfer limit?

There is no transfer limits, however White label Banking reserves the right to decide the no. transactions between accounts based on the account activity and based on our regulatory and legal requirements.

For the higher transaction amount we may ask the source of fund, the corporate would then need to evidence it with bank statements, invoices, and contracts and the compliance team might request additional information.