Growth of Virtual banking solutions in UK

Virtual banking solutions in the UK have witnessed significant growth and innovation, transforming the way people manage their finances and interact with banking services. As technology continues to advance, virtual banking solutions offer convenience, accessibility, and a seamless user experience for customers across the UK.

One prominent aspect of virtual banking solutions in the UK is the rise of digital-only banks, also known as challenger banks. These banks operate solely through digital channels, such as mobile apps and web platforms, eliminating the need for physical branches. Examples include Revolut, Monzo, Starling Bank, and Atom Bank. These digital banks offer a range of services, including current accounts, savings accounts, payment transfers, budgeting tools, and investment options, all accessible through intuitive and user-friendly interfaces.

Virtual e-Banking Enabled for

Freelancer and All Type of Businesses

Get Multiple Account for Multiple Payments

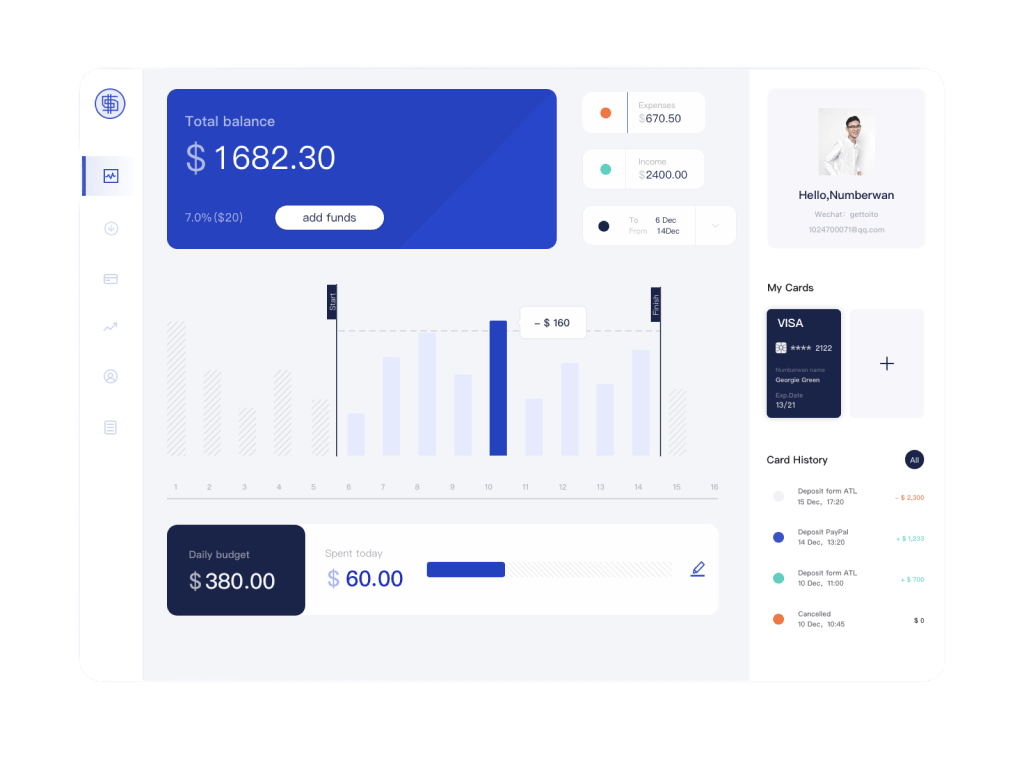

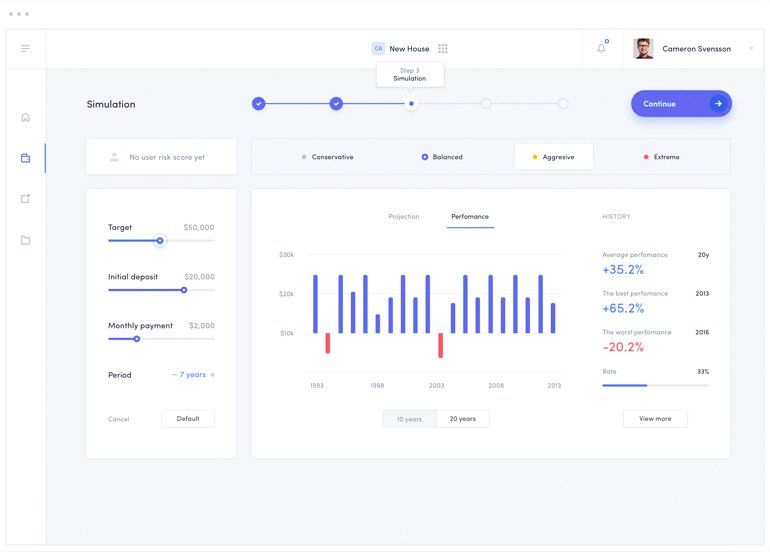

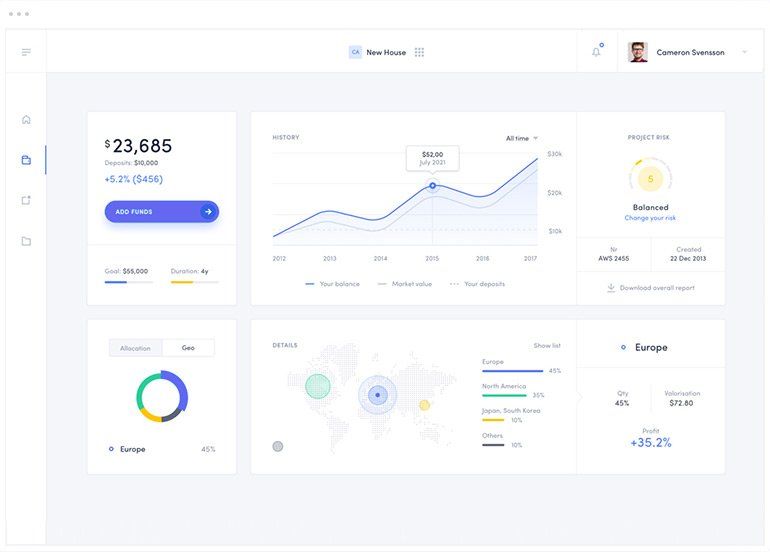

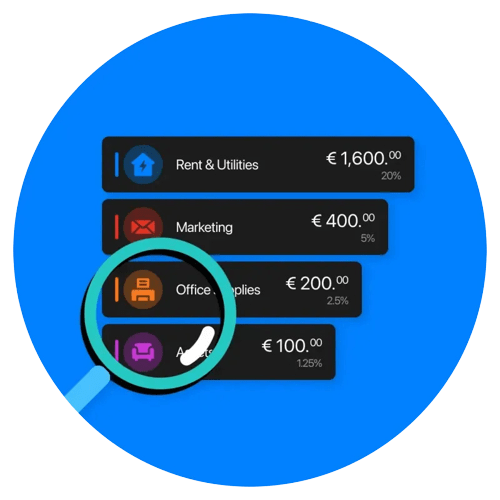

One dashboard to manage fund with up to 25 sub-accounts, and monthly insights into your business spending.

Get Business Card Today

Take 100% control of your bank security

White Label Banking Business Account that save your time & money

Easy and convenient way to get your business IBAN Account at any time, to make transfers, receive funds or perform other financial transactions. FIBANQ allows you to open an IBAN account online in 5 minutes! All you need to do is register and get verified. Activate a personal account free of charge and create additional personal accounts in other currencies.

Get Started